Ready to learn Blockchain? Browse courses like Blockchain for Finance Professionals developed by industry thought leaders and Experfy in Harvard Innovation Lab.

Authors: Kai Schmidt, Philipp Sandner. Download the article as PDF file. More information about the Frankfurt School Blockchain Center on the Internet, on Twitter or on Facebook.

Blockchain technology can solve development problems as it improves existing instruments and enables the development of new ones. Blockchain-based applications particularly address institutional weaknesses and financial inclusion because they restrict deception, corruption, and uncertainties. In the future, the blockchain can also be a development vehicle empowering people directly and mitigating power asymmetries.

Poverty and economic disparities in underdeveloped countries

In its “Poverty and Shared Prosperity Report 2016,” the World Bank reported that “poverty remains unacceptably high” with an estimated population of 766 million people living on less than $1.90 a day in 2013. Many countries located in Sub-Saharan Africa (388.7 million) or South-East Asia (256.2 million) are classified as underdeveloped countries. Nevertheless, significant progress has been made in the past years. Nowadays, especially in cities, a small well-educated middle class exists which can be an important fundament for technological innovations. Innovation has been identified as a means to support development in developed and developing countries (Chudnovsky, Lopez and Pupato, 2006; Kaplinsky, 2011). In general, new technologies can bring significant changes to these countries and improve their living conditions. In particular, blockchain technologies have been suggested as a new technological solution to many problems in underdeveloped countries (e.g. Swan, 2015; D. Tapscott and A. Tapscott, 2016) but has been held to be somewhat nebulous.

In attempting to compensate for this insufficiency, this paper first aims to introduce useful blockchain-based applications and link them to development problems. We seek to create an overview of some of the existing projects and suggested applications. We assess their potential by evaluating the impact scope, the implementation feasibility and the likelihood of adoption. Second, this paper intends to create awareness of new opportunities of the blockchain technology and to motivate governments, international organizations, non-governmental organizations (NGO) and entrepreneurs to leverage them. We show how a new technology (blockchain) could be applied to existing solutions in underdeveloped markets.

Weak institutions

One major problem of underdeveloped countries, and one reason why development programs often do not deliver the desired outcomes, is weak institutions. Corruption, for instance, is more likely to occur in poor regions where a lack of law enforcement is observed (LaPorta, Lopez-de-Silanes, Shleifer and Vishny, 1999; Mauro, 1995). Olken (2006) found that corruption is centralized, with a small group of people causing a considerable share and that rural areas are particularly prone to corruption. Another problem in underdeveloped regions is the low level of social trust. Key determinants of social trust are defined as the reliability of legal institutions and social heterogeneity (Knack and Keefer, 1997). Social trust supports economic growth and improves living conditions for poor people through higher education efforts, investment rates and improved governance (Bjørnskov, 2006; Levine and Renelt, 1992; Uslaner, 2002). Additionally, education levels should be improved. People often cannot afford to send their children to school because they lack the necessary financial capabilities which results in a poverty-education trap (Barham et al., 1995). A possible solution would be to offer parents a loan with which they could finance their children’s education. However, in underdeveloped regions people often do not have access to financial services or are not given a loan (Canidio, 2015). Moreover, power concentration limits economic development on both local and national levels (Acemoglu et al., 2014). Local chiefs have incentives for self-centered ruling and often capture governmental initiatives to strengthen social capital and education levels.

Role of financial intermediaries

The role of financial intermediaries for economic development has also been the object of several studies. Honohan (2008), for example, linked the access to financial intermediaries to poverty. The main problem for people in underdeveloped countries is not only a shortage in capital resources but also limited access to financial services, specifically bank and savings accounts. Low financial inclusion, for example, can harm the effectiveness of redistribution programs as people save half of the additional income and hedge against future losses (Ravallion and Chen, 2005). Financial intermediaries do not only impact poor people directly but also indirectly through companies’ loans and the labour market. In particular, SMEs contribute much to the employment of underdeveloped nations, but little to the economic growth because they are often constrained in raising external capital for e.g. new equipment. Therefore, they cannot close the productivity-technology gap (Gorodnichenko and Schnitzer, 2015). In absence of proper working institutions, innovative financial products have been suggested as possible solutions (T. Beck and Demirguc-Kunt, 2006). As for example, Barth, Lin, Lin and Song (2008) found that shared information registries reduce financial friction and corruption in bank lending, increasing the likelihood of loans for enterprises. Furthermore, the role of financial integration must be investigated. In theory, financial integration helps to overcome the capital constraints of domestic firms in underdeveloped countries and enhances domestic savings, improve capital allocation, decrease the cost of capital (Gur, 2015). Gur (2015) suggested that the dependence on international capital is the main reason for underdevelopment.

Microfinance

Microfinance is regarded as one important development tool for NGOs or other microfinance institutions (MFI) to increase financial inclusion for the poor. This concept relies on a high level of trust because no collateral has to be deposited. Disciplinary mechanisms were often included through group-based lending where one group member is also liable for another group lender’s debt. This incentivizes people to fulfil their commitments and to collaborate with each other so that every group member repays the loan (Kent and Dacin, 2013; Khavul, Chavez and Bruton, 2013). Another concept is the empowerment of people. Galiani and Schargrodsky (2010) analyzed the impact of property rights on people in illegal suburbs of Buenos Aires. They found that land entitling could significantly improve economic development as peopled invested more, household sizes were reduced and fertility rates decreased.

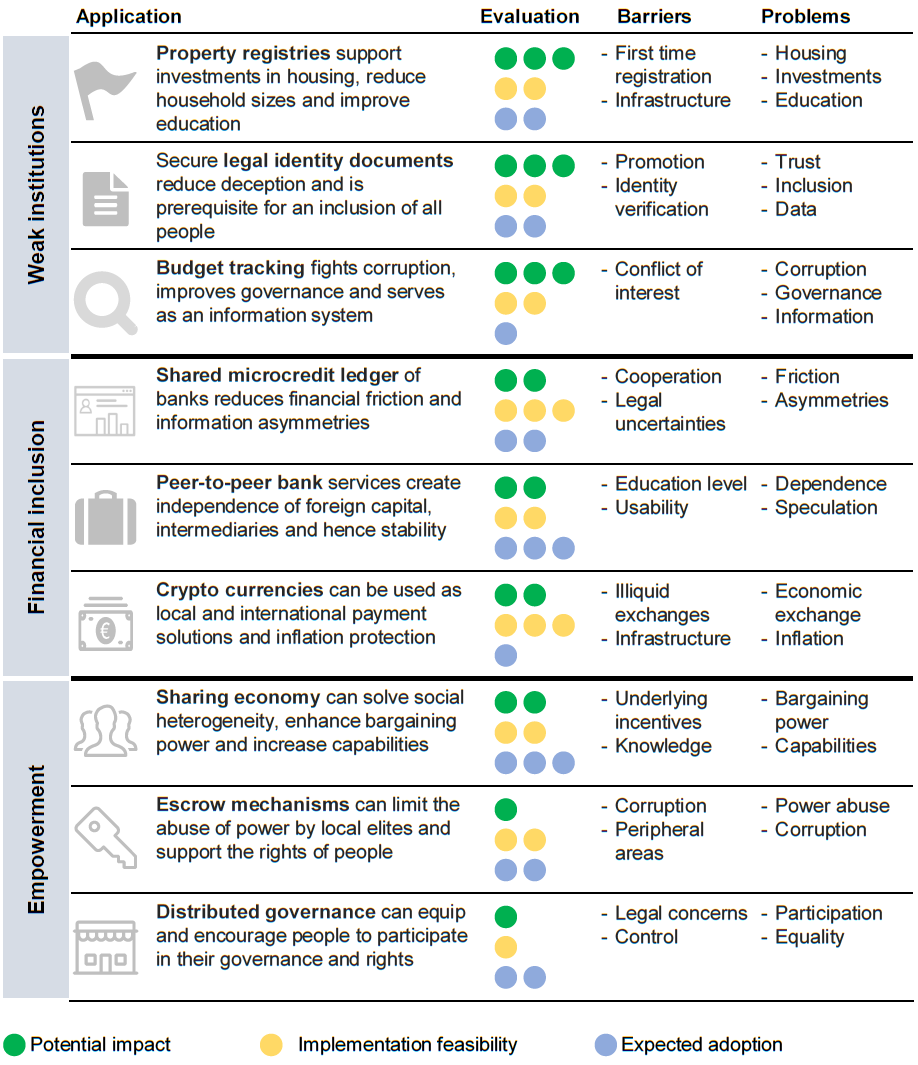

Figure 1: Blockchain-based application as potential solution

Overview over blockchain applications

We propose potential blockchain-based applications divided into three principal segments: overcoming weak institutions and corruption, increasing financial inclusion and empowering people. Blockchain technology can be a very interesting technology to provide a joint basis for exchanging information of transferring value. However, it is important to note that blockchain technology aims at managing information, data and value; it does not per se solves the challenge of gathering the data in the first step which is needed with many applications. As follows, we explain the idea behind the applications and discuss the innovation potential of the blockchain, including the advantages over longstanding solutions. Figure 1 provides an overview over these categories where first prototypes have been implemented or where startups are offering first solutions on a small scale. This figure also depicts the expected adoption by identifying key determinants and requirements.

Blockchain applications to overcome institutional weaknesses

Institutional weaknesses have multifaceted impacts on people and economies in underdeveloped countries. The absence of legal registries and proper documents often prevents people from executing their rights and participating in economic trade (e.g. opening a bank account). Without proper documentation, the system is more prone to corruption and power concentration of the elites. Consequently, the level of social trust is often marginal, complicating economic exchange and limiting development progress. To mitigate those problems, we suggest three major blockchain-based applications: a property registry, basic legal digital documents and a monitoring system for governmental and institutional spending.

A blockchain-based property registry is a public ledger where all real estate can be legally registered and documented. Making property records official enables people to prove their ownership and incentivizes them to invest in their property. This directly improves living conditions and indirectly reduces household sizes and fertility rates, which result in an improvement of the education level. Consequently, the poverty-education trap can be alleviated. Furthermore, giving people legal status and security creates the opportunity to use property as collateral. It is expected that capital of $20 trillion worldwide is lost due to missing land registries (Shin, 2016). Freeing this capital can lead to an economic upswing and new opportunities for poor people and SMEs. Although the implementation of land registries is technically possible without the blockchain, a blockchain-based application solves several implementation and adoption problems of the existing solutions. Due to the absence of control panels, local agents in underdeveloped countries can corrupt registries much easier than in developed countries. In contrast, a blockchain-based solution is transparent and secure and does not allow local agents to alter the registry once the property is documented. The property owner is the only person who can transfer ownership with his or her private key. Furthermore, existing physical databases are often outdated and not maintained properly. Locals often use their own track records without institutional oversight (P. Schaefer and C. Schaefer, 2015). As a result, exact ownership remains unclear and local dispute arises — often between communities also. A common, shared database clarifies ownership and provides an up-to-date overview of ownership structures. This enables institutions and governments to identify and contact stakeholders when they want to buy property or build a new production plant nearby. Therefore, the extent of the impact on people and business environments is considerable.

People might adopt a property registry. Many communities have their own records, implying that they are aware of the importance and advantages of a registry. Therefore, governments have to promote the solution and educate people about the new land registration process. It is critical to make the process easy and transparent. Here, it is important to also consider the access mode: should people access the registry individually with their own mobile devices; or should employees of local authorities access the registry with their computers. Existing registration processes are complex and require significant effort, time and outlay, discouraging people from using them. In contrast, a digital solution reduces registration efforts and transmission barriers dramatically, encouraging people to use this service. Of course, a digital solution is only possible as long as people have access to technological devices.

A blockchain-based property registry has a moderately high probability of being implemented since there are already projects in existence. For example, the Bitland NGO, together with the Land Administration Project, government representatives and the local communities, develops a land registry in Ghana. Initiatives have tried to implement a solution for 17 years, but have failed due to corruption and nepotism (Aitken, 2016). Bitland believes that a blockchain-based application overcomes those problems and can subsequently be expanded to further African countries once it has proven its applicability. Similar projects include BenBen in Ghana, BitFury in Georgia, ChromaWay in Sweden (which aims to reduce costs) or Factom in Honduras (Date, 2016; Rizzo, 2017; Shin, 2016). However, a registry faces several implementation and entry barriers. One of the foremost problems is registering the land in the first place. Once the property is registered, it is secured against corruption and helps to resolve disputes. However, the process of registering the land in a blockchain database can be a subject of corruption and disputes. Thus, initially clarifying ownership is an obstacle. New technologies such as GPS might alleviate obstacles and help measure and record land properly. Furthermore, the underlying infrastructure cannot guarantee continuous energy supplies and internet connection, harming the reliability of the registry. Bitland intends to solve this by establishing local stations with independent internet and (solar) energy. This is associated with high costs and therefore presents a significant barrier to transferring the project to other countries.

Similar to property registries, digital documents can improve people’s lives substantially. The idea is to create a ledger where basic legal documents such as identity documents (IDs), driver’s licenses, birth certificates or marriage documents can be registered. A second step could be to protect intellectual property and create virtual identity management with the blockchain. For the sake of this analysis, we focus on IDs. The absence of IDs is a common problem in underdeveloped countries. It limits the people’s ability to participate in several activities such as opening a bank account, voting in elections or using government services. Appropriate IDs enable people to engage in those activities, but also provide more security for firms, government agencies and aid organizations. As existing documents could be counterfeited, the originality of the documents has to be confirmed in costly and time-consuming processes. Confirmation processes impede economic interactions and harm the overall welfare. In contrast, a blockchain-based solution prevents deception and hence eliminates the necessity of expensive verification practices. It provides organizations with security and trust concerning their counterparts. Moreover, we want to outline the advantages of birth registration based on the blockchain. In general, a proof of existence provides newborns with access to health care and education, protection against abuse and inheritance claims. A blockchain solution could improve birth registration as it is easier to access than traditional approaches. People can easily register infants with their smartphones (or local devices) and do not have to contact agencies, which is often expensive and time consuming and therefore represents a registration barrier. More importantly, rural areas where registration agencies often do not exist can be reached by a blockchain-based application. This results in more accurate and up-to-date databases which can be used for data analytics. In a report published in 2007, AbouZahr, Jha, Macfarlane, Mikkelsen, Setel, Szreter and Stout identified vital statistics as “essential public goods that benefit individuals and societies” (p.1). Without accurate data, governments and international organizations cannot properly compile solution concepts to poverty and monitor development goals. For example, it is impossible to establish educational programs without data on the population, or prevent epidemics without information on the causes of death. Given the extent of those problems, digital legal documents can significantly improve people’s lives, business environments and overall governance.

The likelihood of adoption primarily depends on the hurdles people have to overcome in order to register. The adoption can be divided into two areas: digitalizing existing identities and registering babies. For example, people could register themselves with their smartphones and in return receive a preliminary legal status. With this status, the people would be allowed to execute their rights for a limited time, demonstrating the advantages of legal documents. After a certain time period, their documents would have to be confirmed by a local agent, otherwise their legal status expires. Identity confirmation by a local agent is a barrier due to the high costs of reaching peripheral areas. Additionally, parents must perceive the benefits of registering their children in the first place. Existing processes are often associated with significant effort and expense and therefore are not used. Institutions could link specific services, such as medical coverage for children, to registration and support parents in the process. Regarding other identity and legal documents, the government could start issuing them physically and digitally. After several years, the database would become increasingly accurate. Overall, the rate of adoption relies on the promotion of the advantages and the specific design of the solution, including incentive structures and registration barriers. The promotion efforts can be a significant barrier for companies to provide a solution, given the fact that people often have lived without IDs. Therefore, the adoption likelihood is medium.

As of February 2017, several projects developed identity management systems on the blockchain. ShoCard, for example, builds a service where IDs, driving licenses or passports can be saved on the blockchain. Although this project is based in California, its system could be modified and transferred to underdeveloped countries. Similarly, Onename developed a blockchain IDs which can be used in several transactions and digital identification processes (Perez, 2015). When combining the blockchain advantages with existing solutions such as Orange’s mobile birth registration in Senegal or Uganda’s Telecom mobile platform, the implementation is feasible. Moreover, governments can reorganize registration processes. In Orange’s mobile solution, village representatives or hospitals are equipped with mobile devices and are responsible for sending data on newborns to the central registration (GSM Association, 2013). Using ShoCard’s or Onename’s technology, villages and hospitals could directly document newborns in the blockchain. They could also provide general birth data such as height, weight and the names of the parents. In addition, they could register adults, alleviating the barriers to establishing local agents. Finally, IDs based on the blockchain are impactful and feasible in the long term. The problems associated with the registration of adults and the re-issuance of existing documents in a digital form will disappear after several generations (if new documents and births are registered in the blockchain).

Another potential application is the development of budget-tracking mechanisms. A budget-tracking mechanism has two major impacts. First, it raises the difficulty of corruption and embezzlement as the public or other control panels can oversee officials. A blockchain-based application saves all transactions and allows expenditure tracking. In contrast, existing control processes can often be corrupted or book entries modified to allow the redirection of money. With a blockchain-based solution, it would no longer be possible to fake expenditures since the transaction data (e.g. account numbers, transaction time, transaction amount, receiver) are recorded and can be controlled. A budget-tracking mechanism is not only applicable to national governments, but also to local communities. In fact, local agents perpetrate a considerable amount of embezzlement (Olken, 2006). To clarify, it is still possible to redirect money, but people are discouraged as their actions are listed and can be monitored. Second, blockchain-based budget-tracking could become a source of conclusive information. So far, underdeveloped countries lack the capabilities to screen and analyze their expenditures not only on national but also local levels. Since the blockchain maintains a transaction history, governments would be able to track their expenditures and analyze their budgets, the impact of which having the potential to be highly significant. Budget tracking could also be useful for international aid organizations. Although they are robust against corruption and already use tracking systems, a blockchain system can reduce costs and provide more accurate and current data. Furthermore, they could provide a transparent and granular overview of their impacts and the capital uses. This transparency can encourage people to donate more to aid organizations, but the extent of the impact on underdeveloped countries is low.

The likelihood of the adoption of budget tracking strongly depends on the government’s willingness to bring transparency and accountability into their actions. Since parts of the governments are corrupt themselves and benefit from the current system, they are not incentivized to launch a budget-tracking system. Even if parts of the government want to launch it, they might be restricted by lobbyists and other administration officials. Foreign governments and international organizations could influence the implementation by linking aid payments to implementation progress. Nevertheless, the likelihood of adoption is low in countries with corrupt governments and strong lobbyists. In contrast, international aid organizations are likely to adopt it as they only have to transfer existing procedures to the blockchain.

In general, the implementation feasibility of a budget-tracking system based on the blockchain is possible. There are already projects in existence aiming to bring full transparency to governmental expenditures. One example is the City of London, which discusses the potential use of the budget-tracking system MayorsChain (Willliams-Grut, 2015). While the technology is in development and a transfer to underdeveloped countries is feasible, it depends on the willingness of the governments to accept a solution for their country. This uncertainty over governments and their conflicts of interests presents the main barrier as it discourages companies to build a solution. In contrast, the demand for a tracking system for NGOs exists and encourages companies.

Blockchain applications to improve financial inclusion

People in underdeveloped countries often suffer from financial exclusion. Without access to basic services as such bank accounts, insurance coverage and small loans they are not able to participate in many economic activities, are prone to volatile incomes, cannot expand their businesses and are unable to fulfil urgent personal needs. Furthermore, social inequality rises because the wealthier class of the population benefits from better bank services and investment opportunities. A lack of proper documents and inefficient credit markets are the main reasons for exclusion. Banks often face information asymmetries concerning their customers, including identity confirmation, wealth situation and creditworthiness. As a solution for identification and wealth situation has already been suggested, the following section focuses on information asymmetries regarding creditworthiness and moral hazard. Furthermore, we introduce opportunities to address bank concentration and the negative impacts of financial integration. At the same time, it should be noted that with innovations driven by IT, new challenges emerge concerning data protection of customers — especially with the transparency that blockchain technology provides in some settings.

In order to reduce information asymmetries and moral hazards, MFIs could develop a shared microcredit ledger. In this ledger, different financial institutions could save information about the financial situation of their clients, including data about current loans, collateral, interest obligation, income levels or past repayment rates. To protect privacy, customers have to authorize MFIs to access their data. Therefore, banks can monitor customers’ financial situations and evaluate the risk and conditions of a loan more efficiently. In areas where income levels and the availability of collateral are restricted, factors such as previous repayment rates and current debt balances serve as important sources of creditworthiness. As a result, information asymmetries and financial friction are reduced. Furthermore, a common problem arises from moral hazard and adverse selection. In the absence of monitoring systems, individuals or companies are less obliged to repay their loans. A common ledger ameliorates this issue, incentivizing repayment by rendering borrowers’ future ability to receive loans – and hence their future investment capabilities — conditional upon doing so. One can note that a shared credit information system would benefit banks and borrowers alike as it would improve the banks’ ability to manage risk and borrowers’ terms and conditions. The societal and economic impact can be multifaceted. Not only can individuals fulfil urgent personal needs, but they are more encouraged to start new or expand existing businesses. Therefore, a credit information system also supports entrepreneurial activities. The blockchain helps implement a shared credit ledger because it unites several features. First, multiple MFIs can access the blockchain equally at the same time without the need of a central authority or middleman. This helps to incorporate all relevant players and to capture complete borrower information. Complete information is critical as otherwise information asymmetries and friction both increase. Second, a blockchain-based application saves the full credit history and provides a degree of oversight regarding the volatility of creditworthiness. Due to this, borrowers can receive more and higher-value loans. They can start with small loans and, when they repay them, qualify for more substantial loans. Third, privacy can be protected. A mechanism can be included where borrowers have to grant permission to the bank in order to view the data. Fourth, a blockchain-based solution is resilient against hacking and fraud. This prevents data theft and the illegal trading of sensitive information.

Overall, the need for a shared information system is high. Credit bureaus exist and provide information about borrowers’ creditworthiness in developed countries, but also partly in underdeveloped countries. The case of CREDIREF, a credit bureau in Guatemala, illustrates that MFIs are willing to adopt a solution. However, CREDIREF fails to incorporate smaller MFIs primarily due to high membership fees and complicated information requests (Luoto, McIntosh and Wydick, 2007). When the middleman is replaced by the blockchain, the services are cheaper and faster — therefore the blockchain can potentially alleviate current barriers. Moreover, borrowers must also adopt the solution and accept that they are monitored. However, people are likely to accept the solution as it indirectly benefits them and becomes an industry-wide standard. Therefore, the overall likelihood of adoption is high.

The potential benefits incentivize MFIs or other companies to develop a blockchain-based solution. In fact, several players exist that are trying to establish credit bureaus including CREDIREF in Guatemala or the Central Bank of Lesotho. Those projects often face challenges regarding costs and information inaccuracy which could be minimized using blockchain technologies. They could partner with companies based in developed countries such as KYCK! (Singapore) or KYC-Chain (Hong Kong). Both start-ups developed know your customer (KYC) networks and aim to reduce registration effort by providing and verifying the identities of new customers. (Faife, 2016). Those principles could be applied to shared credit information ledgers and therefore the implementation feasibility is rather high. However, unclear legal frameworks regarding information sharing and the need to incorporate a majority of MFIs represent implementation risks and barriers that might be partially minimized by early governmental incorporation.

Shared credit information systems, legal documents and property registries improve the inclusion and quality of common banking services with traditional intermediaries. But even if those fail, the blockchain can advance development by allowing peer-to-peer banking services. In contrast to traditional middlemen, peer-to-peer services enable people to directly exchange services and offer financial products. The main advantage is that no middleman with superior information or power is needed to connect people. Instead, people can interact directly on the blockchain providing them with a saving and investment tool. Furthermore, a peer-to-peer banking platforms can expand common services with insurance and hedging mechanisms. A farmer might want to insure his business against falling cotton prices, while a local tailor might want to protect himself against rising prices. On the blockchain network, those two parties could be brought together and agree on a future swap. The advantages over existing banking solutions are multifaceted. First, the profit is not captured by the intermediary, but could be split between the two parties in form of lower transaction fees and interest expenses. Second, the two parties can negotiate directly, agreeing on customized conditions. Third, alternative risk assessment methods such as a reputational system or group lending practices could be utilized. This results in a more accurate risk assessment and reduces adverse selection. If people know their counterparts, they can better evaluate the default risk. Moreover, the reach of the solution is much broader than for traditional MFIs which often focus on urban areas. A solution where community members can lend between each other would also work in rural areas. Fourth, two major effects resolve moral hazards. Like shared credit ledgers for MFIs, a repayment history is saved and transparent to future lenders, hence borrowers are more incentivized to fulfil their commitments. Additionally, the borrower interacts directly with his or her counterpart and is therefore more motivated to repay the loan. Fifth, a peer-to-peer system uses domestic capital and therefore minimizes the negative impacts of bank concentration and financial integration. If everyone can lend and borrow money on a free market with no dominant player, no one can dictate conditions and prices. Furthermore, the economy achieves independence from foreign capital. Independence stabilizes the economy because it restricts rapid capital outflows caused by geopolitical events. The economy becomes more resilient to speculations and international crises. The blockchain is able to capture those advantages and overcome problems of existing technologies. The most important feature is distributed power and a network maintained by its users. Existing peer-to-peer lending platforms such as LendingClub, Prosper and ZOPA have become more centralized and institutionalized (Athwal, 2014). The blockchain can prevent centralization because it is based on trust and inclusion. The use of “smart contracts” guarantees that agreements are fulfilled or penalty mechanisms are executed when a party violates the contract. Therefore, no third party has to establish trust and enforce rights.

The likelihood of the adoption of peer-to-peer services depends on several factors. First, it is subject to the future development of MFIs. If they become increasingly profit-oriented and only serve urban areas, the need for a different solution arises. Peer-to-peer services can bypass this need and therefore incorporate poor people. Furthermore, one must distinguish between the services offered. Basic products such as lending and borrowing are easier understood and therefore more adopted than complicated products such as hedging instruments (e.g. price swaps) or insurance contracts. Additionally, it is already common practice in local communities to lend other members money. A blockchain-based application could expand and improve these practices by providing an accurate tool. Moreover, differences arise from the general education level and the cultural background of the population. In some cultures, community members might be more committed to fulfil their obligations. However, the education level and usability are critical inputs for the adoption. Only if companies build practical solutions and explain them properly, people will adopt them. This might be a significant barrier intensified by low profit prospects.

Peer-to-peer lending platforms are not new to underdeveloped countries. Zidisha, for example, is an NGO which coordinates loan activities and brings creditors and debtors together (Alba, 2015). They use mobile phones and mobile payment solutions in order to reach specifically rural areas. A combination with blockchain technology might help them to operate more efficiently and with higher quality. An example of a peer-to-peer platform based on Bitcoin is BTC Jam (everis NEXT, 2016). Although headquartered in San Francisco, the company offers services around the world. The underlying technology could be transferred to underdeveloped countries and support development of peer-to-peer lending. In contrast, insurance and hedging mechanisms have not yet gained significant attention. Therefore, the overall implementation is realistic.

Crypto currencies also represent potential solutions to increase financial inclusion. Due to low registration barriers where no identification is mandatory, everyone can use crypto currencies, which is an advantage over the administrative efforts of opening a bank account (users only have to download a wallet). Due to this, a crypto currency can be used as a local payment solution benefitting small enterprises, which cannot afford to open a bank account or use PayPal services. Additionally, cryptocurrencies reduce transaction fees enabling smaller and more frequent transactions, particularly for poor people. Foreign workers can also use crypto currencies for international remittance. As of February 2017, international remittance is associated with high costs (often up to 7%) (Coleman, 2016). Furthermore, crypto currencies can protect people against inflation. A drop in national currency and a rise in inflation rates particularly harm poor people, who are unable to transfer their capital to safer currencies.

The adoption of crypto currencies is currently limited. Although several solutions exist such as coins.ph, Stellar, Rebit or BitPesa, people in underdeveloped countries have not adopted them (everis NEXT, 2016). The transferability to local currencies represents the main challenge. Because normal economic exchange is based on local currencies, people have to convert their digital coins into fiat money. This is a problem due to illiquid exchanges and an incomplete underlying infrastructure. Rural areas do not have exchanges where people can withdraw and change money. Therefore, although the usage might be beneficial, the likelihood of adoption is low.

Blockchain applications to empower people

The first application we would like to introduce builds on the underlying principle of a sharing economy. Direct interaction between parties without a middleman lies at the core of a sharing economy and can be applied in underdeveloped countries. For example, farmers could sell their crops directly to the end-consumers without large corporations in between which dictate prices. The abuse of market power is particularly strong in settings where competition is barely present and governments do not mitigate monopolies. In this case, a peer-to-peer platform where farmers can trade their products directly is a possible application offering clear benefits. However, middlemen would still be needed in order to transport the products from rural areas. Therefore, we suggest that farmers connect with each other and coordinate their activities. If enough farmers collaborate, they will have bargaining power over large companies. As a result, farmers could protect themselves, strengthen their positions against large enterprises, alleviating price dictation and inequitable treatment. Additionally, the farmers should combine their resources to buy modern equipment which they use together. Consequently, they could afford more effective equipment and overcome price dictation. Although a collaboration platform would be technically feasible without the blockchain, several features simplify the process. The blockchain allows fair and secure cooperation by the use of smart contracts. The farmers have to agree on actions, and those who deviate from them by, for example, using a machine at the wrong time or selling crops at a different price, can face sanctions. Here, adoption depends on communication and education. It is important that farmers understand and commit to the collaboration contracts. If they comprehend the advantages, adoption is likely. However, the implementation might be problematic. As farmers cannot develop such an application themselves, they rely on help from developed countries. Start-ups, however, might not be incentivized to establish such a solution due to low potential profits and high entry barriers (education and promotion costs).

The incorporation of escrow mechanisms in redistribution funds is another possible solution to empower people. Redistribution programs often fail to achieve the desired outcome because they do not reach the targeted people. Local agents or elites often act as middlemen for the local community, resulting in information asymmetries. The agents abuse their superior information and steal the aid of the distribution programs. An escrow mechanism could be incorporated in which agents only receive their rewards when a majority of the local people confirm they were given the aid. A barrier is to ensure that peripheral areas are also reached and that people have access to confirmation devices. The underlying principle could be broadened to education funds. A common problem is that parents misuse aid for investments rather than the education of their children. Due to this, the poverty-education trap cannot be solved.

Additionally, we would like to review distributed governance applications, specifically blockchain-based elections. A common problem is that rural areas are beyond the reach of ballot boxes. In order to vote, the rural population has to travel long distances for which many people do not have the time or money. Furthermore, local ballot boxes can be corrupted, resulting in electoral fraud. A blockchain-based application can eliminate fraud and the need to travel long distances by providing people with the opportunity to vote digitally. The blockchain can achieve this because people can vote with their own or stationary devices. Furthermore, their votes can be anonymized through an anonymous key that enables them to vote. This could fight corruption and power centralization and demonstrate the importance of political participation. Moreover, it can increase social heterogeneity and trust. However, such a project is highly visionary and not feasible in the near future. Legal concerns and control questions are not clarified yet and hinder both implementation and adoption. The start-up “Follow my vote” currently builds a solution for developed countries but could only be transferred if legality and specific designs are clarified (everis NEXT, 2016).

Conclusion and discussion

Summary. In this study, we analyzed the potential impact of blockchain-based applications on people in underdeveloped countries. The first category of applications addresses problems of weak institutions. Specifically, a property registration and an identity registry bring not only legality into people’s lives, but moreover, provide accurate data and improve government programs and development instruments. Similarly, budget-tracking mechanisms capture information about government expenditures, which fights corruption and advances overall governance. In this area, NGOs in cooperation with local governments are the main players and most likely to advance development. The second category aims to amplify financial inclusion for the poor. In particular, a shared microcredit information system results in the better decision making of MFIs and thereby decreases barriers such as financial friction for the poor. The development of such a solution is a new business opportunity for start-ups since local banks are likely to adapt and pay for the services.

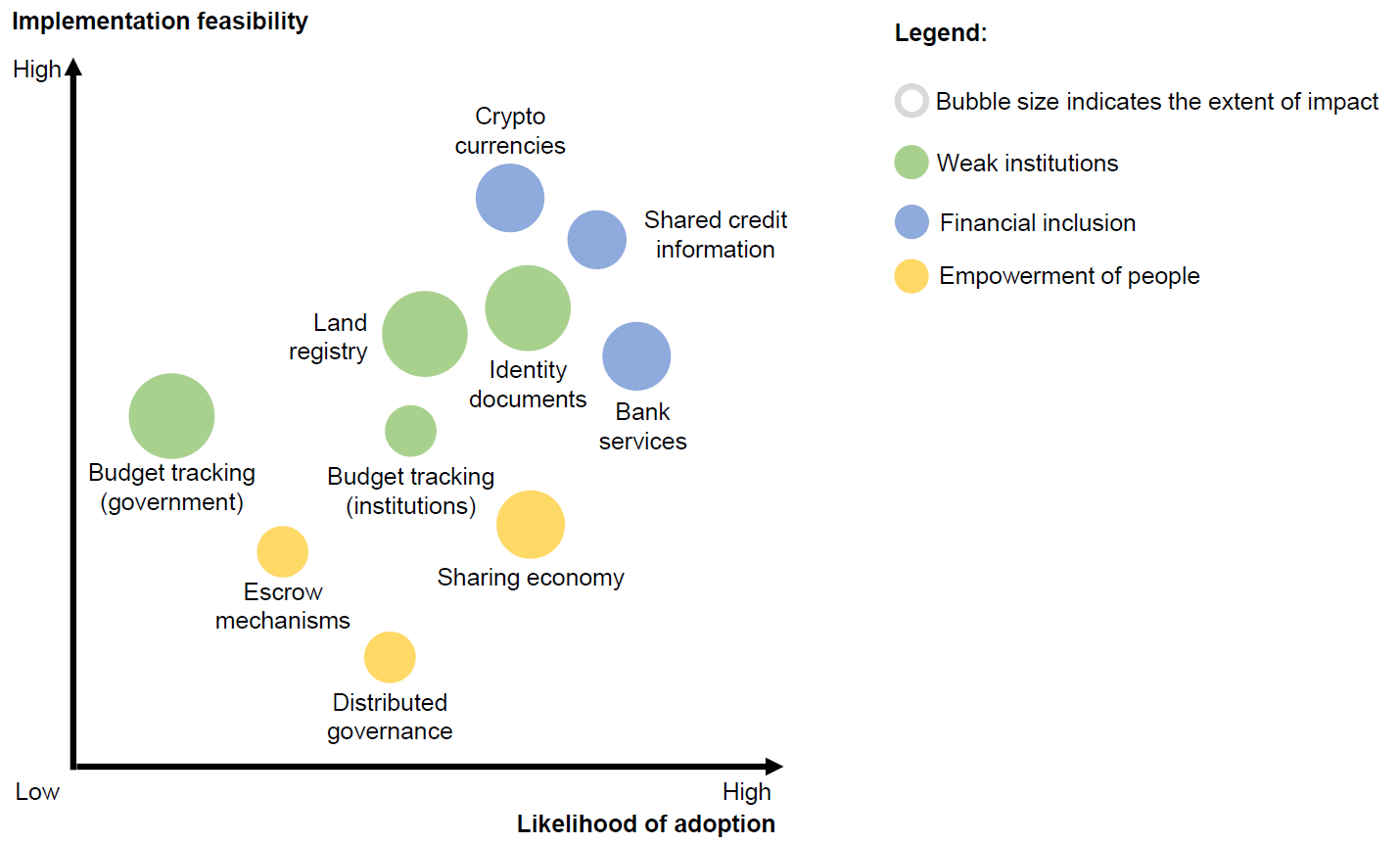

Figure 2: Impact assessment of potential solutions

Another application in which start-ups can play an important role, can be seen in peer-to-peer platforms. Similar projects exist in developing countries but must be transferred and adapted to local needs. Furthermore, we demonstrated that crypto currencies fail to shape development due to illiquid exchanges and low acceptance rates in underdeveloped countries. In the third category, we analyzed applications which empower people directly and make them independent of large corporations and local elites. Specifically, the development of sharing economy applications can achieve this goal, but more precise applications and designs need to be investigated.

Figure 2 shows the implementation feasibility by presenting existing projects from developed and underdeveloped countries and their barriers. Based on this figure, it is possible to evaluate the applications and their disruptive potential in underdeveloped countries. Blockchain technology has the potential to significantly support developing countries with their development. However, it is important to note that in the past years (and decades) much progress has been achieved, e.g. a small well-educated middle class in cities of many developing countries. It is important to combine blockchain technology with the learnings of these achievements. Blockchain technology per se cannot improve people’s lives since it is the mode of implementation this technology in local systems and the way of combining it with other instruments to help these countries develop.

Implications. Building on our results, the governments of underdeveloped countries should support the implementation of applications to benefit general development. They should, therefore, clarify legal frameworks and establish an encouraging business environment. Moreover, they must build the necessary underlying infrastructure, including reliant energy supplies and internet connections. If governments are unable to provide this, NGOs and international institutions (e.g. the World Bank) should fill this gap and provide infrastructural programs. Furthermore, international institutions can exert pressure on governments and link foreign aid to conditions, e.g. establishing budget-tracking systems. Moreover, entrepreneurs should cooperate with NGOs to apply the blockchain technology on existing projects such as birth registration. They should also transfer existing solutions from developed countries and implement them in underdeveloped regions (e.g. peer-to-peer lending platforms).