Top articles, research, podcasts, webinars and more delivered to you monthly.

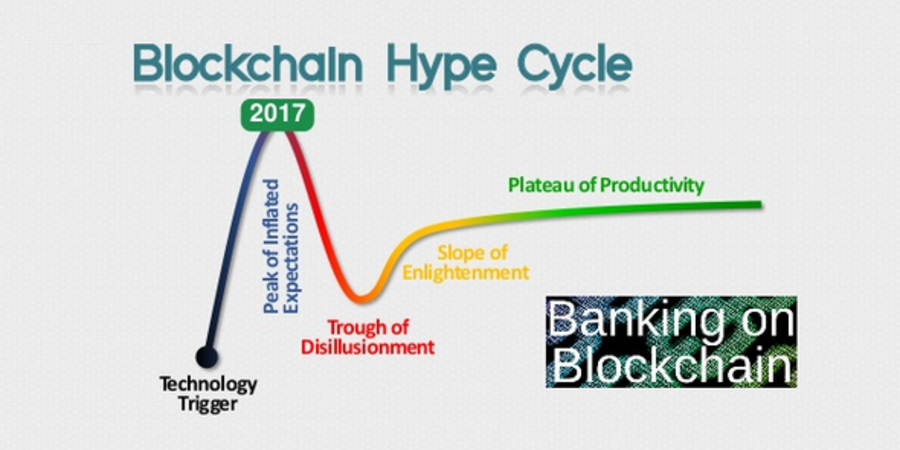

Blockchain-as-a-Service: the accelerator for blockchain adoption

A large scale adoption of blockchain by corporates and others has long time been hindered by the lack of options....